- Personal

- Membership

- Membership

- Rates & Fees

- Checking

- Checking

- Personal Loans

- Personal Loans

- Wealth Management

- Investment Services

- Financial Advisors

- Resource Center

- Business

March 31, 2022

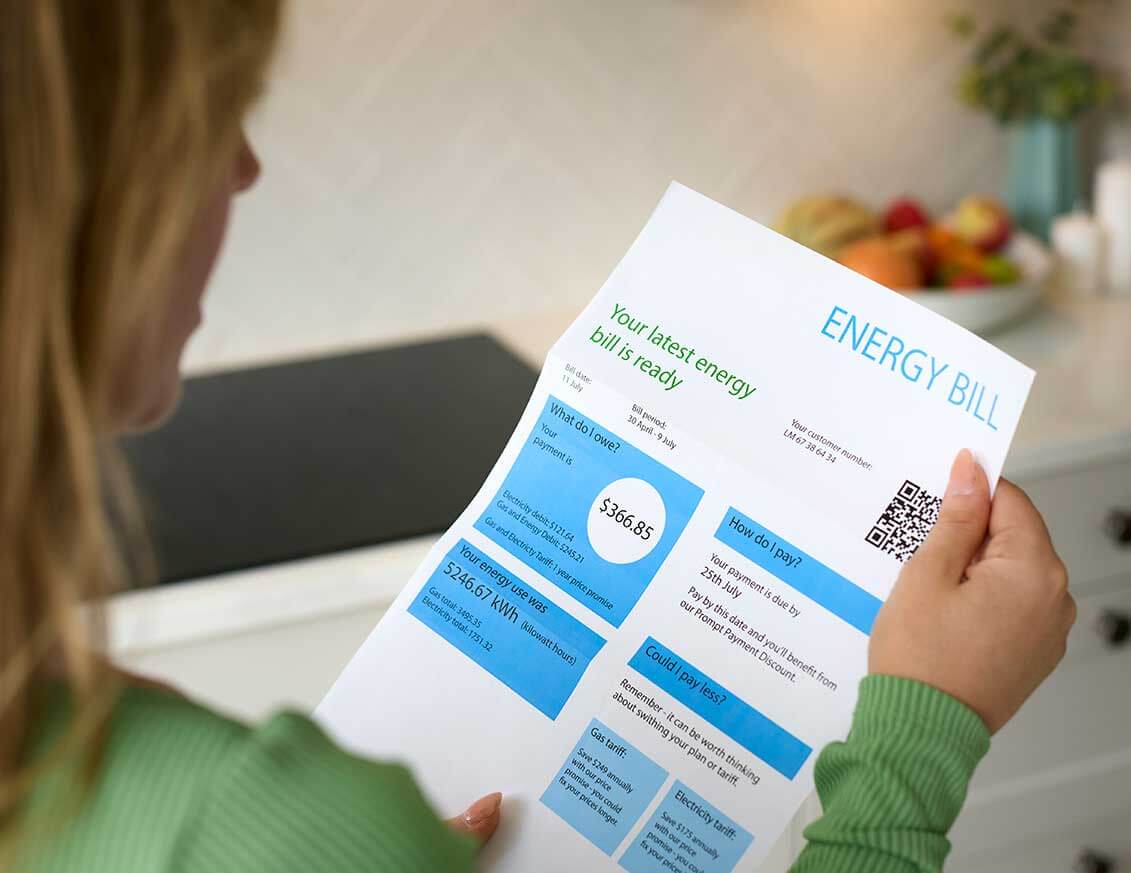

How to Lower Your Gas Bill

A higher than expected natural gas bill is not the kind of surprise you enjoy getting in the mail. It’s not just you—natural gas prices are on the rise nationwide. Try these 10 changes to lower your bill.

1. Stay on top of maintenance. Perform regular maintenance on your natural gas furnace and water heater to avoid issues that could be driving your bill up. Leaks, dirty filters, and other needed repairs make your system less efficient and require more energy (read: dollar bills) to run smoothly.

2. Turn down the water heater. Lower the temperature on your water heater to the perfect Goldilocks setting—not too cold, not too hot. Many residential water heaters are set as high as 140 degrees, but most people don’t need water that hot, so why pay to keep it that way? Ideal bath water temperature is between 90-105 degrees.

3. Try alternate energy sources. Research other sources of energy in your area that may be more economical than natural gas, such as solar panels or electric heat pumps. Startup costs for new systems can be high, so crunch the numbers before you make the switch to see if the investment is worth the payoff.

4. Insulate your home. If your home isn’t properly insulated, you’re paying to heat air that’s not staying inside. Install fresh caulk or weatherstripping on windows and doors where you can feel a draft and heat is escaping. Insulating your water heater helps, too. Even keeping windows covered with blinds or curtains traps heat inside on cold days.

5. Check your vents. Make sure all your vents are open, and rearrange bulky furniture or appliances blocking vents for maximum airflow. Proper airflow through vents reduces stress on your heating system, so less energy is required to operate it efficiently.

6. Turn down the thermostat. Lowering the thermostat by a few degrees can save you as much as 5-10% on your natural gas bill. Start with small adjustments and see what works for you.

7. Wear warmer clothes. If you lower your thermostat and still feel chilly, layering clothes and blankets is an easy solution. With a cozy sweater or warm pants, you may not even notice a change—except in your wallet.

8. Buy a smart thermostat. A smart thermostat can make a serious impact on your monthly gas bill. Smart thermostats automatically adjust heating and cooling temperature settings based on your preferences, turning temps down when you’re away and raising them for comfort when you return.

9. Keep your system closed. Keep windows and doors shut while your heating system is running to avoid wasting hot air. Use wood-burning fireplaces sparingly, too, because much of the heat leaves through the chimney and creates a vacuum that draws cold air in through cracks in your insulation.

10. Sign up for the budget plan. Many natural gas suppliers offer a “budget” plan that equalizes customer payments based on typical use. So instead of $200 monthly payments half the year and $35 payments the rest of the time, for instance, you pay $120 every month and know what to expect.

Even small changes can add up quickly when it comes to lowering your natural gas bill. Pick 1-2 habits to tweak starting out and see the savings snowball over time.

Disclaimer

While we hope you find this content useful, it is only intended to serve as a starting point. Your next step is to speak with a qualified, licensed professional who can provide advice tailored to your individual circumstances. Nothing in this article, nor in any associated resources, should be construed as financial or legal advice. Furthermore, while we have made good faith efforts to ensure that the information presented was correct as of the date the content was prepared, we are unable to guarantee that it remains accurate today.Neither Banzai nor its sponsoring partners make any warranties or representations as to the accuracy, applicability, completeness, or suitability for any particular purpose of the information contained herein. Banzai and its sponsoring partners expressly disclaim any liability arising from the use or misuse of these materials and, by visiting this site, you agree to release Banzai and its sponsoring partners from any such liability. Do not rely upon the information provided in this content when making decisions regarding financial or legal matters without first consulting with a qualified, licensed professional.

Posted In: General

Explore All The Ways We Can Help You Grow

-

Calculator

Calculator

Rent Affordability Calculator

Estimate how much rent you can afford under a budget.

Keep Reading About Rent Affordability Calculator -

Article

Article

Quality vs Cost

Get tips to decide where you should splurge and where you should save.

Keep Reading About Quality vs Cost -

Coach

Coach

Understanding Health Insurance

Deepen your understanding of how health insurance works as you walk through a common scenario step-by-step.

Keep Reading About Understanding Health Insurance

Lost or Stolen Card?

We’re here to help. If your card has been misplaced or stolen, we’ll act quickly to protect your account. You can report a missing card in the following ways:

Online and Mobile Banking

Log in and follow these three easy steps:

- From the menu, select Tools

- Select Card Manager

- Report your card as Lost or Stolen*

By phone or at a Grow store

Call 800.839.6328 to speak to a team member or let us know in person at any Grow store.Notice: Taking these steps will immediately cancel your card to prevent unauthorized transactions. If you find your card later after reporting it lost or stolen, it cannot be reactivated.

*The selected card will be canceled and removed from Manage Cards when it is reported as lost. Once your new card has been issued, it will be available in Manage Cards. The replacement card will have a new card number. Your replacement card will be sent to the mailing address on your account, and you should receive it within 7 to 10 business days.

How to Find Your Routing & Account Numbers

When you make a payment online, by phone or on a mobile device, you may be asked for our routing number and your checking account number. Credit unions and banks use these numbers to identify accounts and make sure money gets where it’s supposed to be. You’ll also need to provide your routing and checking account numbers for:

- Direct deposits

- Electronic checks

- Military allotments

- Wire transfers

Where to Find Your Routing & Checking Account Numbers

Your personal checks include both our routing number and your account number, as shown on the Grow check example below.

Where to Find Your Checking Account Number in Grow Online and Mobile Banking

If you don’t have a physical check on hand, you can also locate your Checking Account Number for Electronic Transactions in Grow Online and Mobile Banking.*

Here’s how to find it:

- In the Grow Mobile Banking app, select your checking account, then tap Show Details in the top right corner.

- In Grow Online Banking, select your checking account, then click Account Details.

Don’t have a Grow check or Online Banking? No worries.

Visit any Grow store or call us and ask for a Direct Deposit Form. It lists both your routing number and checking account number.

Making a Loan Payment

When it comes to making payments, we try to make it as painless as possible to pay your loan every month. We have several different ways to pay, including convenient online options.

Pay Online

You have two ways to pay online by transferring funds from another bank or credit union.

- Grow Online Banking (Preferred payment method for any loan)

This is the simplest way to pay your loan. You can make one-time payments or set up automatic recurring payments in Grow Online Banking. Once you log in, select “Transfer/Payments” from the menu. If you’re not enrolled in Grow Online Banking yet, you can set up your account in just a few minutes.

Log In

- Debit Card or ACH (Available for auto, personal loans and HELOCs)

Note: ACH and debit card payments are not available for credit cards or most mortgages, except HELOCs.

We accept ACH payments with no additional fees, consumer Mastercard® and Visa® debit cards with a convenience fee of $4.95, or commercial Mastercard® and Visa® debit cards with a convenience fee of 2.95% of the payment amount. To get started with an online ACH or debit card payment, select Pay Now below.

Pay Now

Pay by Mail

You can also pay any Grow loan by check through the mail. Please remember to include your account number and Grow loan number on the check. (For credit card payments, please do not write your 16-digit credit card number on the check, which can cause a delay in processing the payment.)

Address for auto, credit card, personal loan and HELOC payments:

Grow Financial Federal Credit Union

P.O. Box 75466

Chicago, IL 60675-5466Address for personal first or second mortgages and home equity payments:

Grow Financial Federal Credit Union

P.O. Box 11733

Newark, NJ 07101-4733You Are About To Leave GrowFinancial.org

At certain places on this site, there are links to other websites. Grow Financial Federal Credit Union does not endorse, approve, represent, certify or control those external sites. The credit union does not guarantee the accuracy, completeness, efficacy, timeliness or accurate sequencing of the information contained on them. You will not be represented by Grow Financial Federal Credit Union if you enter into a transaction. Privacy and security policies may differ from those practiced by the credit union. Click CONTINUE if you wish to proceed.